TechniTrend Premium Trading Indicator

Candle Pattern Detector (CPD) Indicator

Indicator Overview

The “TechniTrend: Candle Pattern Detector (CPD)” is a powerful tool designed to enhance the analysis of candlestick patterns across financial charts to understand market behavior. This indicator detects a wide range of reversal and continuation patterns, providing traders with insights into potential market movements. It incorporates dynamic filtering and customizable settings for precision in pattern recognition, allowing users to tailor the detection criteria to different trading styles.

Indicator Info

🔷Key Features

Comprehensive Pattern Detection: Identifies numerous candlestick patterns, including bullish and bearish reversals, continuation setups, and indecision formations.

Dynamic Filtering Options: Filter patterns are based on trend conditions, moving average positioning, and additional criteria to increase signal accuracy.

Customizable Input Settings: Provides adjustable parameters, such as body ratios and shadow length requirements, enabling traders to fine-tune detection thresholds.

Real-Time Alerts: Generates alerts when patterns are detected, ensuring traders can respond swiftly to market opportunities.

Graphical Representation: Visualizes detected patterns on the chart using intuitive labels, colors, and markers, helping to identify key signals quickly.

Supported Patterns

The indicator covers a wide range of candlestick patterns.

❇️ 51 Candlestick Patterns

🟢Bullish Reversal Candlestick Patterns:

Bullish engulfing – Hammer – Morning star – Piercing line – Three white soldiers – Inverted hammer – Three Inside Up – Bullish Harami – Tweezer Bottom – White Marubozu – Dragonfly Doji – Three Outside Up – Bullish Counterattack Line – Bullish Abandoned Baby – Bullish Tri-Star – Hammer Doji – Morning Star Doji

🔴Bearish Reversal Candlestick Patterns:

Bearish engulfing – Shooting star – Evening star – Hanging man – Three black crows – Dark cloud cover – Hanging Man Doji – Three Inside Down – Bearish Harami – Tweezer Top – Black Marubozu – Three Outside Down – Bearish Counterattack Line – Gravestone Doji – Evening Star Doji – Bearish Abandoned Baby – Bearish Tri-Star

🟩Bullish Continuation Candlestick Patterns:

Rising Three Methods – Bullish Kicker – Mat Hold Bullish – Three Line Strike – Upside Tasuki Gap – Rising Window

🟥Bearish Continuation Candlestick Patterns:

Falling Three Methods – Bearish Kicker – Mat Hold Bearish – Three Line Strike Bearish – Downside Tasuki Gap – Falling Window – On Neck Bearish

🟡Indecision Candlestick Patterns:

Doji – Long Legged Doji – Spinning top – High Wave

Usage Recommendations

Optimized for Any Market: Designed for stocks, forex, cryptocurrencies, and other assets.

Ideal for Multi-Timeframe Analysis: Use it across different timeframes for better market timing.

Customization Options

Pattern Detection Settings: Users can adjust parameters like body-to-range ratios, shadow length requirements, and gap conditions for accurate detection.

Moving Average Filtering: Choose separate moving averages for reversal and continuation patterns to filter out false signals.

Table Display: These tables display pattern counts, allowing traders to assess the frequency and significance of various candlestick formations quickly.

Alert Configurations: Set custom alerts for specific patterns to stay informed about potential trading opportunities.

Story of Candlestick Pattern:

Candlestick patterns have a rich history rooted in ancient Japanese trading practices dating back to the 17th century. They were first developed by rice traders to visualize price movements and detect patterns reflecting market psychology. The logic behind candlestick patterns lies in the emotions driving market participants—fear, greed, uncertainty, and hope—captured through the open, high, low, and close prices.

Each pattern tells a story about buyers’ and sellers’ behavior, illustrating shifts in sentiment that can signal reversals or continuations in the market trend. By recognizing these patterns, traders can anticipate potential price movements and make informed decisions. The longevity and continued relevance of candlestick analysis highlight its effectiveness in understanding market dynamics.

🔓Unlock Access

Check out the Pricing Page or Dm me to Access the full version of the candlestick analysis with TechniTrend: Candle Pattern Detector (CPD).

Premium Access

Unlock exclusive, advanced indicators with unique features designed for deeper insights.

In-Depth Analysis

Offers comprehensive analysis tools for accurately spotting market patterns and trends.

Universal Markets

Suitable for all markets—stocks, crypto, forex, and commodities alike.

Short & Long-Term

Ideal for both short-term trades and long-term investment analysis.

Customizable

Personalize settings for optimal alignment with your trading style and needs.

Alerts

Receive timely notifications for important market signals, always keeping you updated.

Other Indicators

Advance Custom Candle Finder (CCF) Indicator

Advance Custom Candle Finder (CCF) indicator

TechniTrendMaster Indicator

TechniTrend Premium Trading IndicatorTechniTrendMaster Indicator Indicator Overview The TechniTrendMaster indicator is...

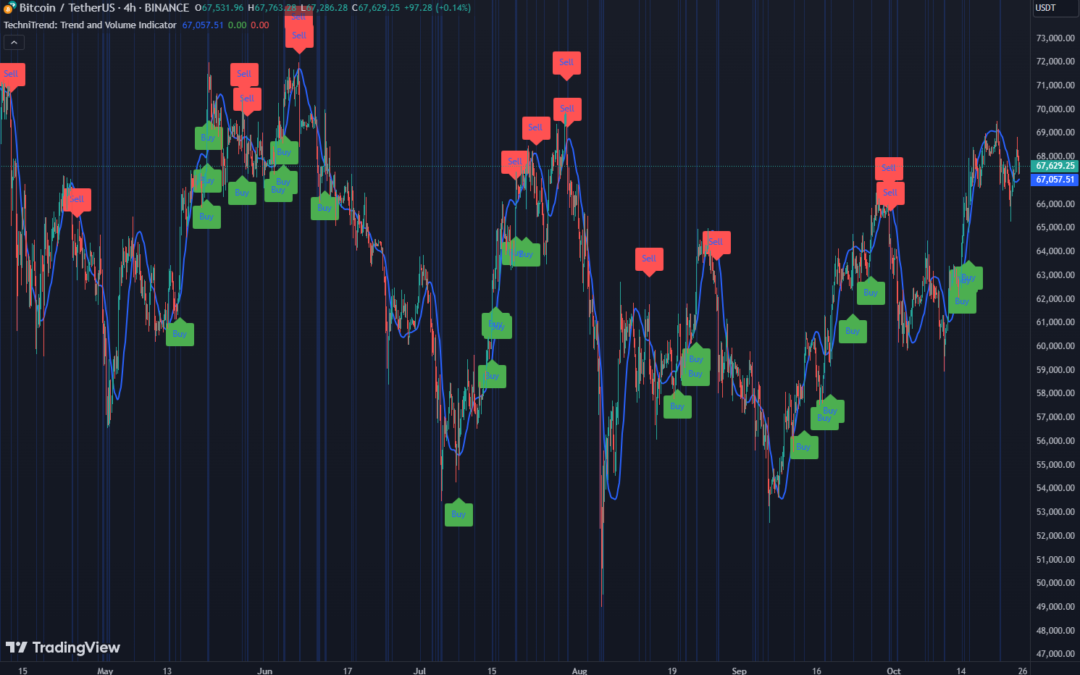

Trend and Volume Indicator

TechniTrend Free Trading IndicatorTrend and Volume Indicator Indicator Overview The "TechniTrend: Trend and Volume...

Dynamic Pair Correlation Indicator

TechniTrend Free Trading IndicatorDynamic Pair Correlation Indicator Indicator Overview The TechniTrend: Dynamic Pair...